UK Inflation rate holds steady at 2.2% despite rise in air fares

Getty Images

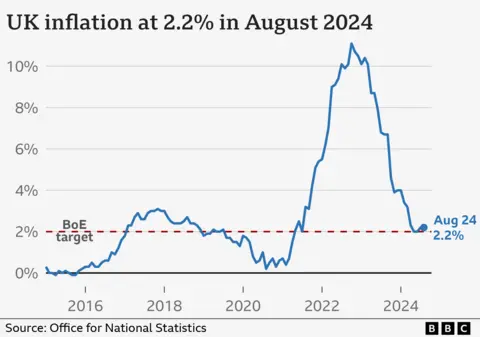

Getty ImagesInflation held steady at 2.2% in the year to August, despite a jump in the cost of flights.

The rise in air fares was offset by lower fuel prices and prices in restaurants increasing more slowly, the Office for National Statistics (ONS) said.

The latest figures come as the Bank of England is expected to keep interest rates unchanged at 5% when it meets on Thursday.

Separate figures showed that private rents across the UK increased by 8.4% in the year to August.

The latest inflation figure means overall prices are rising at a pace slightly above the Bank of England’s target of 2%.

But the rate is significantly lower than at the peak of the cost of living crisis in 2022.

Grant Fitzner, chief economist at the ONS, said inflation “held steady” in August as price falls in some areas compensated for rises in others.

“The main movements came from air fares, in particular to European destinations, which showed a large monthly rise, following a fall this time last year,” he added.

“This was offset by lower prices at the pump as well as falling costs at restaurants and hotels. Also, the prices of shop bought alcohol fell slightly this month, but rose at the same time last year.”

Raw material prices also fell last month, driven by lower crude oil prices.

While rents rose sharply, house prices went up in line with general prices at a pace of 2.2% in the twelve months to July.

High fares

Air fares rose by 22% between July and August. The price of flights usually goes up in the summer, but this was the second largest month-on-month rise in airfares since 2001, the ONS said.

Overall, services, which includes hospitality as well as transport, saw prices rise 5.6%, up from 5.2% in the year to July.

However, motor fuel prices fell 3.4% over the year.

Falling costs at restaurants and hotels also meant prices in those sectors rose at 4.4% in the year to August, a slowdown from previous months.

Darren Jones, Chief Secretary to the Treasury said while lower inflation was welcome, the government understood “that millions of families across Britain are struggling”.

“Years of sky-high inflation have taken their toll; and prices are still much higher than four years ago,” he added.

That has left people running hospitality firms under pressure to absorb rises in costs, rather than keep putting up prices for customers.

“People see a price on a menu, and they don’t necessarily think about the rent, the wages and all those costs that we have to incorporate into that final price that you see,” said Natalie Jenkins, who has run the Moreish restaurant in Shrewsbury since 2020.

Ms Jenkins is still concerned that higher prices will prompt customers to cut back further on having a second cup of coffee, or going out for lunch.

“I think it’s a painful, painful road ahead,” she said.

But Danni Hewson head of financial analysis at AJ Bell thinks a corner has been turned this year when it comes to prices.

“For the consumer it is an improving picture, especially when it comes to filling up cars or kitchen cupboards,” she said

“August delivered the seventeenth consecutive month of falling food inflation, although many shoppers are still struggling with the cost of everyday essentials – something which is likely to get more acute as the nights draw in and the heating goes on.”

The Bank of England does expect inflation to tick higher again in the second half of this year, with household energy bills rising again in October.

But prices are not forecast to rise as steeply as they did in 2022 and 2023, which prompted the Bank to raise interest rates to 5.25%

The Bank cut interest rates for the first time since the crisis at the start of August, after inflation came down to its target of 2% in May and June, but is expected to hold them on Thursday.

“Today’s data are unlikely to unlock another rate cut by the Bank of England tomorrow,” Yael Selfin, chief economist at KPMG UK, said.

“While we expect the Bank of England to look beyond the anticipated higher headline inflation, services inflation remains elevated.”

Most economists think the Bank is more likely to cut rates at its next meeting in November.