Treasury Secretary Bessent met this week with Warsh, Lindsey and Bullard as Fed chief search continues

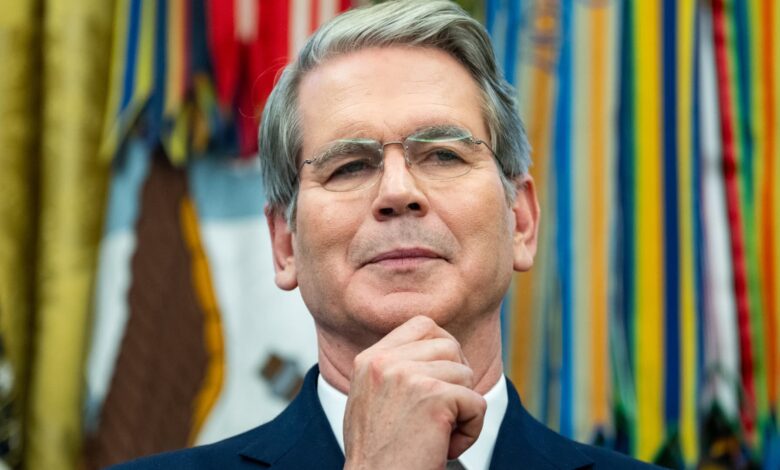

Scott Bessent, US treasury secretary, in the Oval Office of the White House in Washington, DC, US, on Wednesday, Aug. 6, 2025.

Bonnie Cash | Bloomberg | Getty Images

The search for the next Federal Reserve chair is continuing, with Treasury Secretary Scott Bessent taking point in meeting with several candidates on President Donald Trump’s short list.

In recent days, Bessent has met with former Fed officials Lawrence Lindsey, Kevin Warsh and James Bullard, a Treasury source told CNBC’s Steve Liesman. Lindsey and Warsh both served as governors and Bullard was president of the St. Louis Fed.

While the goal is to add one or two names to candidates Trump has already mentioned, including Warsh as well as National Economic Council Director Kevin Hassett and current Governor Christopher Waller. There is a broader a group under Bessent’s consideration that includes 11 economists, including former and current central bankers and a few market strategists remains in play.

In addition to the candidate interviews, Bessent is pushing forth his own agenda for reforming the Fed. He would like to see the central bank organically reduce the massive bond portfolio on its balance sheet, the source said. The key would to reduce the $6 trillion in holdings of Treasurys and mortgage-backed securities in way that is not disruptive to markets or the economy.

Moreover, Bessent wants to try to reduce the Fed’s economic footprint, the source said.

The news comes with the Fed under a White House microscope.

Trump and multiple other administration officials have been pressing the Fed for an interest rate cut, something that hasn’t happened since December 2024. Markets widely expect the rate-setting Federal Open Market Committee in fact will approve a quarter percentage point reduction when it meets next week.

In a Wall Street Journal opinion piece last week, Bessent laid out his own vision for the Fed. He rejected what he called “gain of function” activity in which the central bank has repeatedly overstepped the narrow objectives assigned to it for low unemployment and inflation.

“The Fed must change course,” Bessent wrote. “Its standard tool kit has become too complex to manage, with uncertain theoretical underpinnings.”

The Fed’s complexion could change considerably over the next year.

Chair Jerome Powell’s term expires in May 2026, and while he could stay on for two more years as governor, he is certain to be replaced in his current post. At the same time, the Senate is expected to take up a vote Monday on nominee Stephen Miran for a Board of Governors vacancy.

Trump also has pushed to oust Governor Lisa Cook on accusations of mortgage fraud, though a court has blocked him from doing so thus far