Israeli strikes on Iran’s ‘oil island’ could send crude prices soaring

2024-10-03 22:33:00

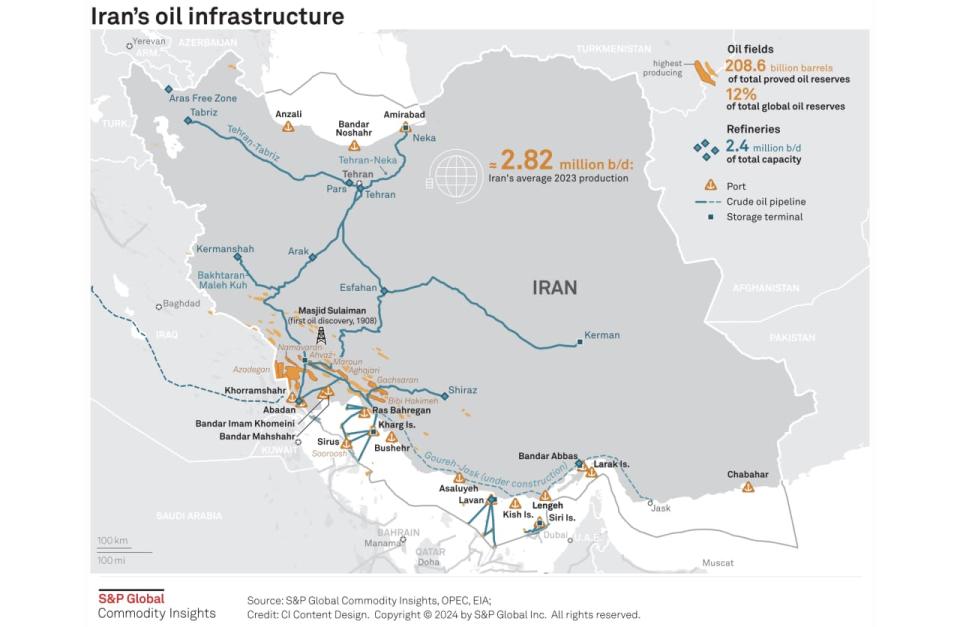

What worries oil traders the most as tensions build in the wake of Iran’s missile attack on Israel is a potential disruption to the flow of crude in the Middle East — and when it comes to Iran, the Kharg Island export terminal could be a key target for the Israel Defense Forces.

“Kharg Island is where Iran loads the majority of its crude exports,” said Matt Smith, head U.S. analyst at Kpler. “That, as a target, would cripple crude exports the most.”

Most Read from MarketWatch

Contributing to a spike during Thursday’s session was U.S. President Joe Biden’s response, when asked by the press whether he would support Israel striking Iran’s oil facilities, that discussions were being held.

Most of Iran’s crude-oil exports are sent through Kharg Island, which is located in the northeastern part of the Persian Gulf, according to the U.S. Energy Information Administration, and is sometimes referred to as Iran’s “oil island.”

The flow of oil through the Strait of Hormuz — a narrow waterway that borders Iran and is the most sensitive transportation chokepoint for global oil supplies — is also a significant concern.

The waterway averaged 21 million barrels per day in oil flow in 2022, representing 21% of global oil consumption, according to the EIA.

“If Iran oil production and exports were disrupted, then other OPEC countries could produce more oil relatively quickly to prevent a prolonged oil shortage,” said Rob Thummel, who manages the Tortoise Energy Infrastructure Total Return Fund TORIX at energy asset manager Tortoise.

“The difficulty is that the likely oil supplier to fill any gap of Iranian shortfalls is Saudi Arabia or Kuwait,” he told MarketWatch. “These barrels would have to be transported through the Strait of Hormuz. If Iran could successfully close or disrupt oil transportation through the Strait of Hormuz, which borders Iran, then the world has a larger problem.”

Thummel said a prolonged disruption, such as a closure of the strait that temporarily reduces global oil supply by 20%, would cause oil prices to “temporarily spike” — potentially over $100 a barrel.

Keep in mind, however, that the U.S. is “keenly aware of the significance of the Strait of Hormuz and is likely to use all means to keep the strait open,” Thummel said.